This year’s FCC Form 499 deadline, April 3rd, is fast approaching. For wholesale telecommunications providers, common pitfalls in reporting practices could leave you at risk of greater exposure to USF liability. In particular, all revenues reported in Block 300 as “wholesale” and exempt from USAC’s USF assessment must be properly supported by documentation in order to qualify for the exemption. Failure to obtain sufficient evidence –such as a legally sound USF Exemption Certification—can result in USAC reclassifying Block 300 revenue (exempt wholesale) as Block 400 revenue (non-exempt retail), thereby exposing the 499 Filer to USF fees, late penalties, and interest, going back in time up to five (5) years and potentially longer.

Revenue reported as exempt wholesale in Block 300 is an area USAC pays very close attention to during its reviews of 499 filings. USAC frequently finds errors in reseller certificates, sometimes technical (such as missing information) and other times substantive (where the 499 Filer’s exemption form is inaccurate, as a matter of law). USAC focuses on wholesale revenue reporting practices because it is not difficult to find errors and omissions that ultimately lead to the imposition of increased USF contribution liabilities.

Block 300 Revenue Reporting Fundamentals

Filers reporting revenues in Block 300 as wholesale (also referred to as “carrier’s carrier”) revenues must demonstrate that they had a “reasonable expectation” that another business in the resale chain was making the required USF contribution. The FCC outlines specific standards for establishing that reasonable expectation, including a safe harbor for filers that follow the standards. These standards mandate the contents and form of the exemption certificates, including specific certification language. However, companies which fail to comply with these specifications are considered outside of the “safe harbor” and subject to greater scrutiny as to the sufficiency of their exemption certificates and claims. Mistakes and omissions in the exemption form can exclude a company from claiming “reasonable expectation” under FCC rules.

Simple mistakes can easily go overlooked. Errors in date, signature, or boxes checked and unchecked can nullify the exemption pass-through certificates you receive from your customers. More significant are errors in how the forms are drafted, some of which are designed to collect an array of information in addition to Block 300 support. Because exemption certificate forms are copied and shared widely in the industry (“monkey see, monkey do”), errors can spread quickly among filers who rely on statements from their customers to support USF exemptions. Whatever the cause, a deficiency in your Block 300 certifications may lead to re-assessment by USAC and USF exposure.

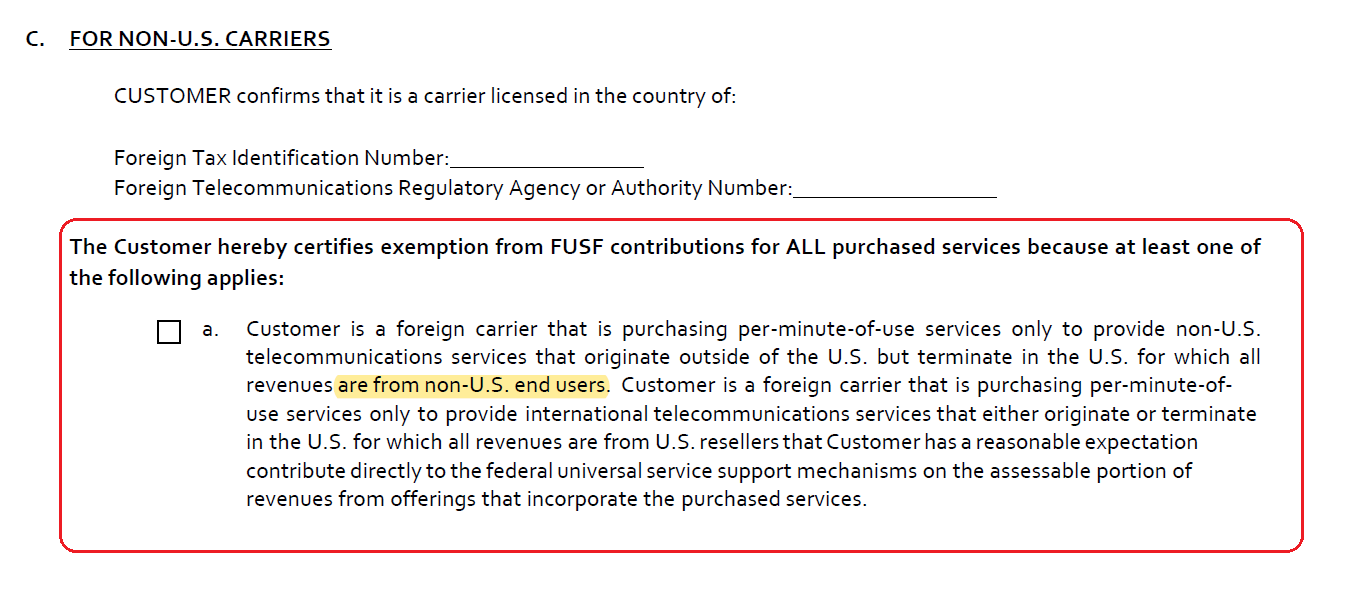

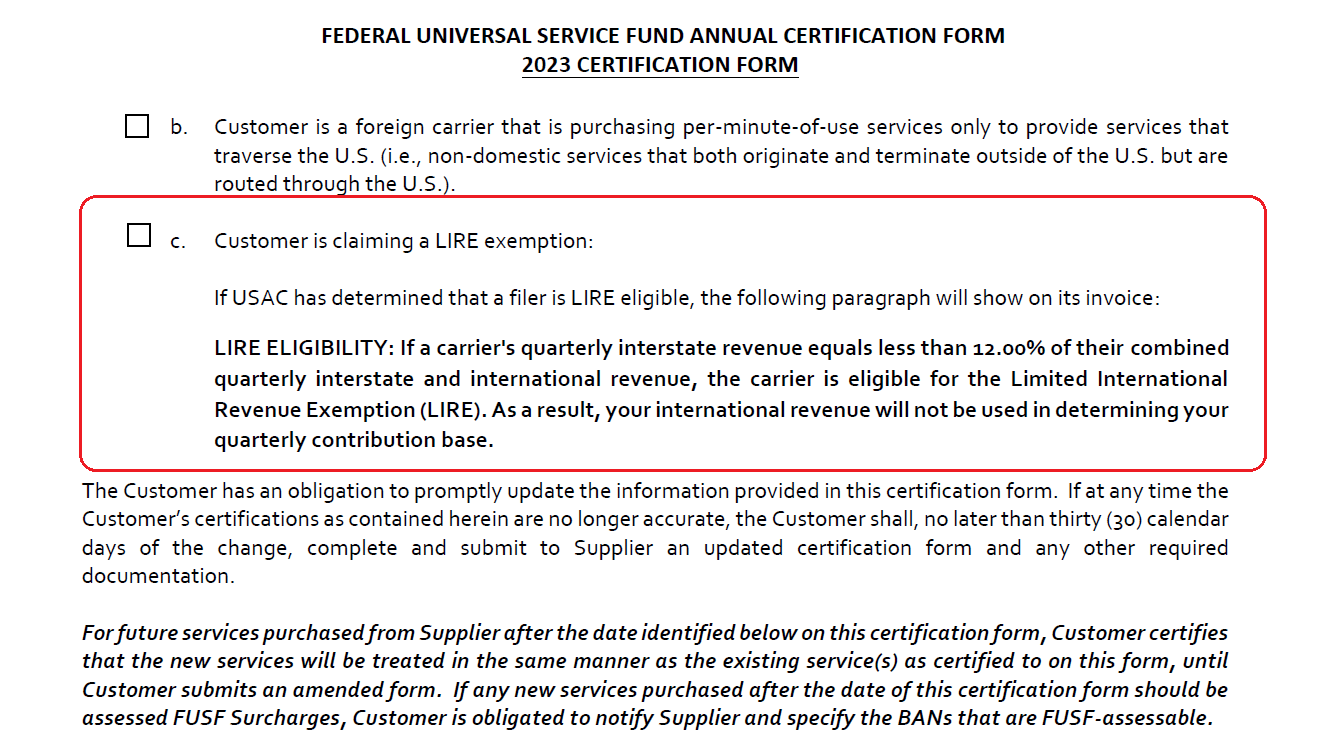

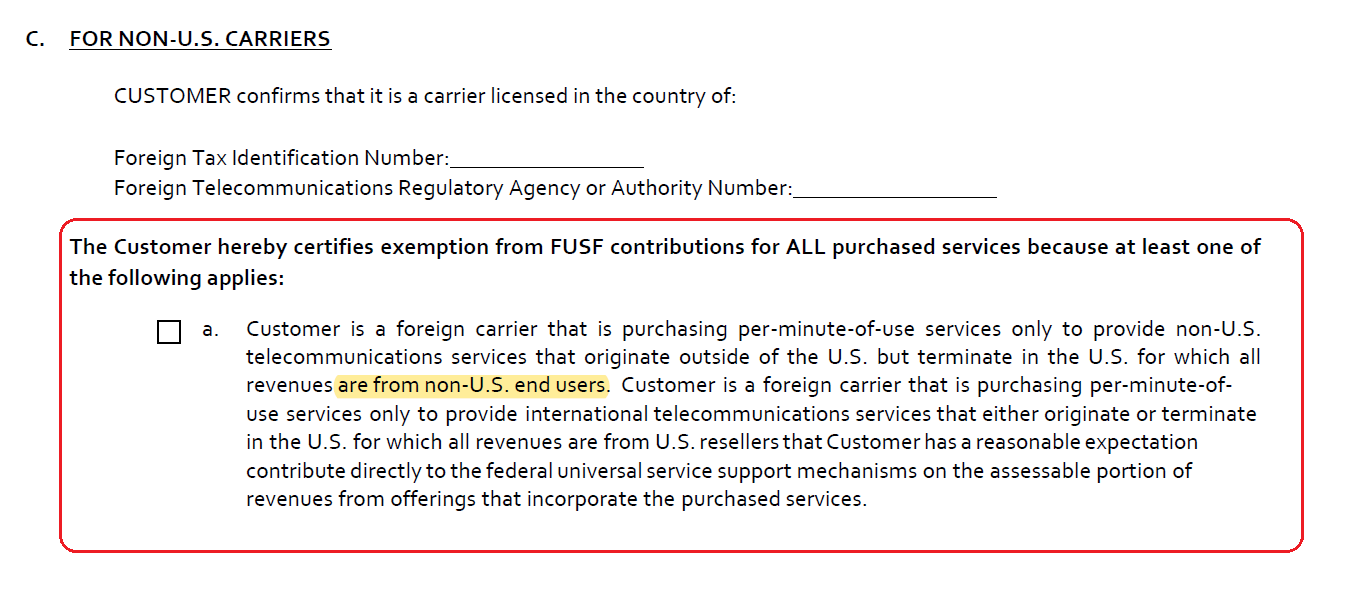

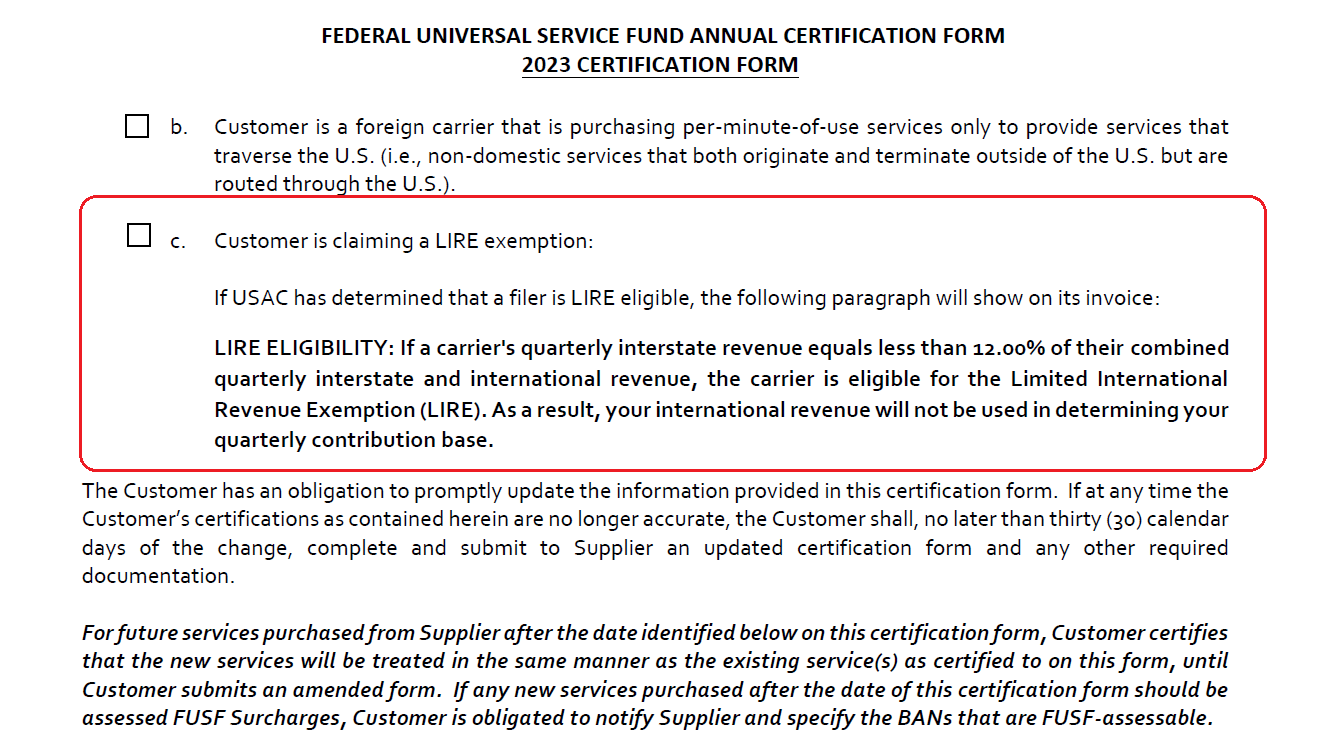

Following are examples of language found in USF Exemption Certification forms currently in circulation that materially diverges from the USAC/FCC “safe harbor” and underlying FCC rules. Therefore, reliance on resellers certifying exemption from USF pass-through surcharges pursuant to one or the other provision highlighted below may result in USAC disqualifying the claimed USF exemption and, ultimately, reclassification of revenue from “exempt” to “not exempt”:

The good news is that there is still time to identify and mitigate the consequences of your company’s 2022/2023 compliance practices, including addressing deficiencies arising from your company’s reliance on potentially defective and legally infirm USF Exemption Certification forms. The attorneys of The CommLaw Group are ready to review your documentation and identify deficiencies that could result in an adverse audit finding, should your 2023 499-A filing be subjected to a USAC Issue Notice and review. We can evaluate the documentation you are using to support Block 300 reporting and assist you in complying with the FCC’s standards. We can also counsel your company on any of the commercial implications vis-a-vis wholesalers and/or their customers (resellers) who may have unwittingly relied upon legally infirm exemption procedures and forms.

If you have any concerns or questions regarding this or any other aspect of your company’s FCC Form 499-A reporting responsibilities, please contact Jonathan Marashlian at jsm@commlawgroup.com before the April 3rd deadline (or soon thereafter, as the FCC rules permit Filers to submit (downward) revisions within one (1) year of the annual deadline).